Tokyo Disneyland and DisneySea’s operator, Oriental Land Company (OLC), has released its financial results for the first half of the current fiscal year, which have some interesting takeaways. This post summarizes the key points about the record profit, attendance numbers, and plans to increase investment in the theme parks.

For starters, everything in the financial results will be wholly unsurprising to those who paid attention to the Walt Disney Company’s earnings calls for the two years before 2023. Well, minus Bob Chapek and all discussion of streaming services, linear television, and other albatrosses on theme parks. So basically, 100% better!

All joking aside, it’s worth reviewing the actual fiscal results released by OLC. It’s basically a Powerpoint presentation and is entirely in English. It’s arguably easier to digest than Disney’s financial results, with the only point where this is debatable being in that all values are in yen instead of dollars. But even then, there are comparisons to the past, so it’s simple as long as you understand the concept of “percentages.”

With that in mind, I’m not going to fixate on most of the specifics. If you really care that much, you’ll read the browse through the 41-page presentation yourself. (It should take less than 15 minutes.) If you don’t, a consolidated runthrough of the key takeaways followed by our commentary should suffice.

First, OLC upgraded its operating profit projection to 146.7 billion yen (approximately $980 million) for the full 2024 fiscal year, which is an increase of 31.9% year-over-year and up 24.5 billion yen from the previous forecast. However, it’s fair to point out that Tokyo Disney Resort was still operating at significantly reduced capacity as part of its phased reopening last year.

As with Walt Disney World and Disneyland, it thus makes sense to look back to Tokyo Disney Resort’s last normal year: 2019. During that fiscal year, OLC had a record operating profit of 129.2 billion yen, which was then up by 17.2% as compared to the prior year. It’s possible that 2020 would have surpassed 2019 had the parks been open for the entirety of that time, but for the first 9 months of that fiscal year, profits were actually down 5%. (Digging deep because we’ll circle back to this in the commentary.)

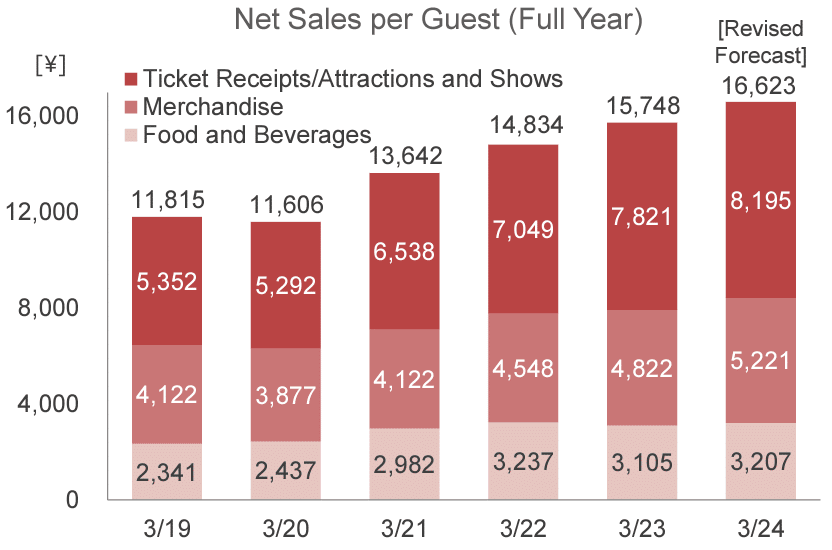

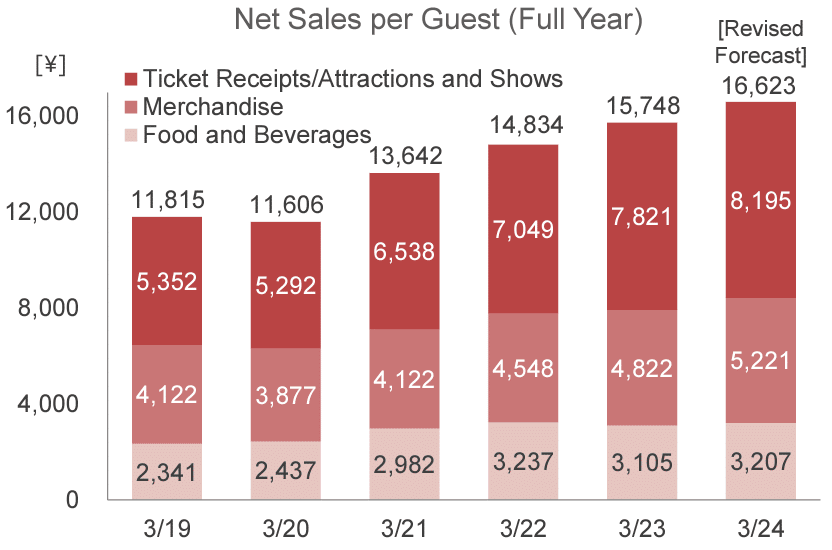

The big driver of the record profit is higher per-guest spending. (Sound familiar, Walt Disney World fans?!) Oriental Land has raised its forecast sales per guest to 16,623 yen ($111.52); that’s up 593 yen from the previously projected amount of 16,030 yen.

That’s up from the previous medium term forecast of 14,500 yen for this year. Looking forward, OLC has revised its forecast for next year up to approximately ¥17,000. As for the why of this, it’s attributed to strong sales of Disney Premier Access, the paid FastPass service at Tokyo Disney Resort. (Again, sound familiar?!)

Tokyo Disneyland’s 40th Anniversary is also presented as a main driver of spending. Strong sales of both merchandise and food & beverage associated with the anniversary were drivers of higher spending. Interestingly, a lower proportion of guests doing table service meals did drag this down a bit.

Looking forward to the remainder of this fiscal year and 2025, Tokyo Disney Resort has introduced a variable pricing system that adjusts admission depending on anticipated crowd levels, raising the highest price of an adult one-day ticket by 1,500 yen to 10,900 yen in October. Additionally, Disney Premier Access line-skipping will roll out at more offerings.

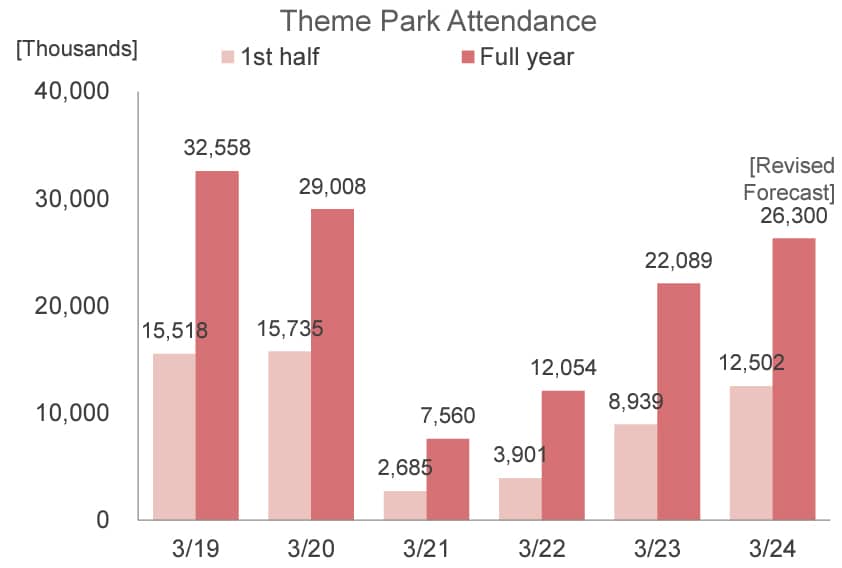

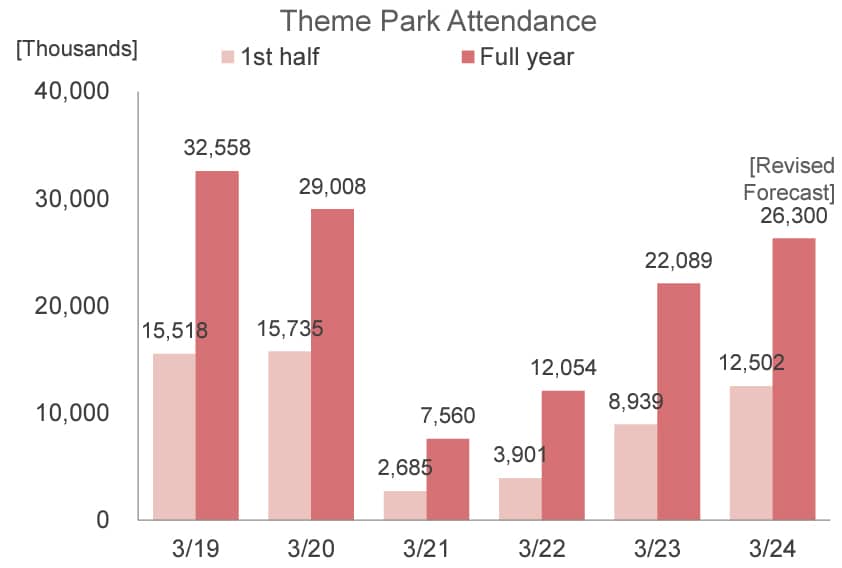

Tokyo Disney Resort is the only Disney resort complex that releases official attendance numbers, because it’s the only one not owned in full or part by the Walt Disney Company. Anyway, attendance increased by 40% to 12.5 million in the first half of the fiscal year.

Overall attendance for the fiscal year ending March 2024 is now forecast as 26.3 million guests, up 300,000 from the previous forecast. That projection would put the parks at 19.1% higher than last year, and at 80% of the record high set in the 2019 fiscal year. Again, these are numbers comparable to what Walt Disney World was reporting in 2021 and into 2022–just delayed by nearly 2 years as a result of Japan’s slower reopening.

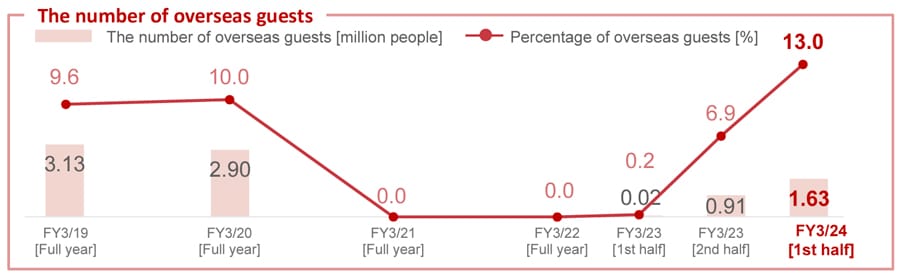

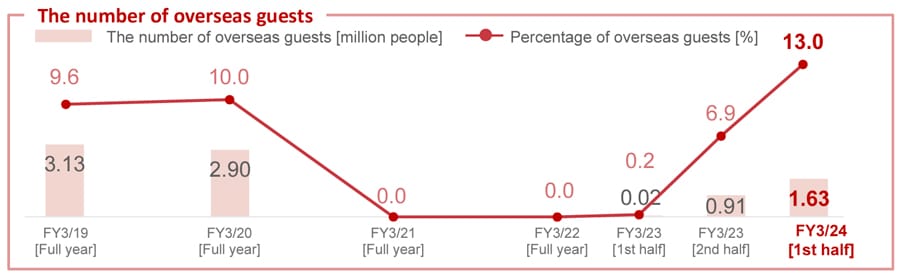

International visitors now account for 13% of attendance at Tokyo Disney Resort, which exceeds the previous record of 10% set in the 2020 fiscal year.

For 2021 and 2022, the percentage of overseas visitors was 0.0%. That makes complete sense, given the stringent border closure that resulted in inbound foreign visitor numbers in the tens of thousands, as opposed to tens of millions. In any case, the increase for the second half of last year and first half of this year are impressive.

However, I’d probably also add a caveat that Annual Pass sales remain suspended. Although OLC doesn’t attribute the increase in per-guest spending or higher proportion of international visitors to that, it’s undoubtedly made a difference. If locals have to purchase tickets with every visit, they’re spending more when they do attend–and going less, in the first place. Again, we’ve seen this movie before with the reopening of Walt Disney World.

Looking forward, OLC anticipates strong demand for Tokyo Disneyland’s 40th Anniversary events to continue in the 2nd half of this fiscal year. It also reiterates that the suspension of Annual Passports will be continued, and that APs are not expected to resume in the 2025 fiscal year, either.

OLC also notes that the daily limit on attendance was recently increased compared with the level set during the first half of the current year. Going forward, careful consideration will be given in deciding whether to further ease the limit.

In view of the strong demand in the 1st half, the proportion and number of overseas guests expected in the 2nd half is likely to be around 9% and 1.2 million, respectively. As in past fiscal years, the number of overseas guests in the 2nd half of the year is expected to be less in comparison with the 1st half.

According to OLC, this is because inbound tourists from countries other than mainland China tend to visit regional areas of Japan. (This makes sense–Tokyo isn’t exactly a draw for fall colors.) Although restrictions on the group travel have been lifted, the increase in the number of guests from mainland China in the 2nd half is expected to be limited, judging from the recent status of flight ticket issuance.

For the 2025 fiscal year, OLC has issued an attendance forecast of 28.5 million guests. That’s a massive increase as compared to the current fiscal year, which previously was adjusted from 26 million to 26.3 million.

At minimum, attendance is expected to be maintained at the same level as in the current year. On the one hand, the end of Tokyo Disneyland’s 40th Anniversary will have a negative effect on numbers. Conversely, the increase in capacity due to the opening of Fantasy Springs coupled with the further increase expected in the number of overseas guests due to a rise in the number of inbound tourists will help attendance increase.

OLC notes that in the early stages of opening of Fantasy Springs, the area will be operated with controlled capacity in view of demand and guests’ experience value as well as our operational proficiency with the aim of maintaining high experience value.

The company also adjusted its medium-term business plan through the 2025 fiscal year due largely to Fantasy Springs and these unanticipated results. OLC expects Fantasy Springs to boost consolidated sales by an annual 75 billion yen or so, up from 50 billion yen. Of that, around 20% will be due to higher hotel revenue. (There’s a new hotel in Fantasy Springs, which will be the big boost–but it’s safe to expect higher rates and slightly higher occupancy at the other hotels, too.)

On the whole, OLC now expects consolidated operating profit of 160 billion yen for the 2025 fiscal year. Again, that’s up from a forecast of 146.7 billion yen for the current fiscal year, which will be a record.

Due to these record results, OLC is now allocating additional funds to investment in Tokyo Disneyland and DisneySea. (Imagine that–when theme parks overdeliver, the company that operates them invests more in them, rather throwing good money after bad on other money-losing ventures. What a crazy concept!!!)

Oriental Land Co. will now invest 215 billion yen in growth ($1.44 billion US) and 90 billion yen ($604 million US) in upgrading its parks, up from the previously-planned 160 billion yen and 75 billion yen that was announced in its medium-term plan. After the Fantasy Springs expansion, Oriental Land plans to reimagine Space Mountain and its plaza in Tomorrowland. That has a budget of 56 billion and should fall into the upgrades bucket, since it’s described by OLC as a “renovation and renewal” in this report. (I could be wrong on that, especially given that it leaves very little for other upgrades.)

It’s also notable that the business strategy for enhancing theme park experience value will not be revised. The OLC Group will strive to create a consistently pleasant theme park environment by promoting efficient operations with a lower limit on daily attendance than before the outbreak of COVID-19 and by seeking to even out attendance levels.

Turning to commentary, again, a lot of this probably sounds familiar. On the one hand, I’m not shocked by the strong profits and attendance. Although the report itself doesn’t contain the words “pent-up demand,” that’s definitely a big driver. Japan also has had significant fiscal stimulus targeted at tourism, which is another contributing factor. This is hardly speculative; the Bank of Japan has discussed these topics in its economic outlooks.

It’s also not surprising because our visits to Tokyo Disneyland post-reopening had some of the worst ‘feels like’ crowds we’ve ever experienced. However, that also came at a time when a notable number of restaurants and retail locations were still closed, and entertainment was suspended. Reductions in capacity have an outsized impact on congestion there, just as they do at Walt Disney World, making an apples to apples comparison of crowds from 2019 to today nearly impossible.

What is surprising is that this is all happening without Annual Passes. I don’t have exact numbers or even approximations, but if you told me that Tokyo Disney Resort had more Annual Passholders than Disneyland Resort in California as of 2019, I would totally believe it. (In fact, I would proactively make that bet.) Tokyo Disneyland and DisneySea are very much locals’ parks, and the crowds on weekends bear that out–even more so than Disneyland.

It’s really remarkable that Tokyo Disney Resort is so close to 2019 attendance numbers without Annual Passes, and that alone should vindicate their decision to keep APs suspended for so long. Although that’s been a really sore subject with Japanese Disney fans, if you’re reading this, presumably that is not you. It’s a net positive for international tourists to have APs suspended. (Sorry, locals!)

Circling back to the per-guest spending number, which works out to be ~$112 US. No, that is not a typo. Park tickets are significantly cheaper at Tokyo Disney Resort, as is food and most merchandise. (Only “most” because Duffy stuff is absurd–it’s like that bear and his posse subsidize the rest of the resort.)

When compared to Walt Disney World or Disneyland, this is arguably more than a little misleading. For one thing, the dollar is incredibly strong versus the yen right now. Great for Americans traveling internationally, but a non-factor for the vast majority of Japanese guests who are paid and pay for things in yen.

To that point, median household income is also significantly lower in Japan than in the United States. So yes, Tokyo Disney Resort is cheaper than Walt Disney World or Disneyland. That’s true no matter how you slice it. For the local audience, though, the contrast is not as pronounced as it might seem. Nevertheless, it’s one of the many reasons why we encourage Americans to visit Japan!

Looking forward, one big wildcard is whether Japanese guests postpone trips while waiting for Fantasy Springs. We’ve already updated our When to Visit Tokyo Disneyland in 2023-2024 post with some of this commentary, but figured it’s worth reiterating here–especially since we’ve now reviewed 2019 and 2020 financial reports for this article.

As noted above, attendance was down 5.3% in the first 9 months of the 2020 fiscal year (through December 31, 2019–the full fiscal year report offers less value due to the COVID closures). Notably, this was after Tokyo Disneyland’s 35th Anniversary ended on March 25, 2019 but before the large-scale expansion (Beauty and the Beast, etc.) was slated to open on April 15, 2020.

It was basically a lull year between a major celebration and a colossal expansion. In other words, a similar setup to the first half of the 2024 calendar year. The biggest difference, in our view, would be the Annual Passes and seasonal events that were used then to maintain relatively stable attendance throughout the year at that time.

With Annual Pass sales still paused–and highly unlikely to resume until after Fantasy Springs opens (unless there are significant blockout dates)–that dynamic is different. Pair that with slowing pent-up demand and more cautious consumer spending, and our view is that it’s highly likely that tourists and even local diehard Japanese Disney fans will postpone visits to Tokyo Disneyland and DisneySea in the first 5 months of 2024.

Right now, it seems like a very safe bet that attendance numbers in April and May 2024 will be lower than they were this year. To a lesser extent, the same should be true for January through March 2024. However, it’s possible that locals will want to get in last visits before the end of Tokyo Disneyland’s 40th Anniversary, or there will be a Grand Finale, of sorts, to that.

Another possibility is that return of seasonal events in Winter and Spring 2024. This would kind of make sense regardless, as OLC wants to keep increasing capacity and they’re probably now able to staff more of these celebrations. It would also be savvy from the perspective of drawing locals to the parks at a time when there might otherwise be a pretty significant lull. Back in early 2020, that was more or less what happened, with the introduction of the ‘Very Very Minnie’ event. Bringing that back, or something else entirely, along with Easter would make a tremendous amount of sense.

Otherwise, OLC might be looking at more than a 5% drop from this January through May to January through May 2024. Against the backdrop of slowing pent-up demand more broadly across Japan, reduced consumer spending, locals postponing visits until Fantasy Springs opens in June 2024, and no Annual Passes, it sure seems like OLC will need to pull some “levers” to sustain this level of success in the near-term. In the medium and long-term, they should have no trouble continuing this record-setting run in the years to come. Turns out that investing in theme parks and not just treating them as cash cows to be milked is smart business. Who knew?!

Planning a trip to Tokyo Disney Resort? For comprehensive advice, the best place to start is our Tokyo Disneyland & DisneySea Trip Planning Guide! For more specifics, our TDR Hotel Rankings & Reviews page covers accommodations. Our Restaurant Reviews detail where to dine & snack. To save money on tickets or determine which type to buy, read our Tips for Saving Money post. Our What to Pack for Disney post takes a unique look at clever items to take. Venturing elsewhere in Japan? Consult our Ultimate Guide to Kyoto, Japan and City Guide to Tokyo, Japan.

YOUR THOUGHTS

What do you think of OLC’s financial results for the first half of the 2024 fiscal year? If you’ve been to Tokyo Disneyland or Tokyo DisneySea this year, what did you think of crowds or prices? Looking forward to visiting in the first half of 2024 or after Fantasy Springs opens? Do you agree or disagree with our analysis? Any questions? Hearing your feedback—even when you disagree with us—is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!